Weekly Update

Weekly Update 11-Feb-2026

-

Forced selling exhausts itself

-

But the rebound is in the economy sensitive stocks not Big Tech

-

Retails Sales disappoint…but Employment shines

-

Takaichi wins the mandate in Japan, and the market rewards her

-

Earnings growth is still accelerating

-

Software companies say their revenues are growing, but nobody believes them

-

Delinquencies on consumer loans are on the rise, should we worry? (no)

-

Quick Hits

-

Where did all the crypto money go?

-

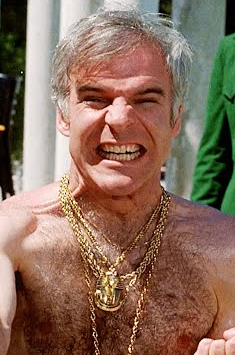

Chart Crime of the week

-

This guy did not cause the panic

After last week’s Artificial Intelligence scare, the buyers came roaring back. What exactly changed overnight from Thursday to Friday? Not too much fundamentally. But we feel more comfortable in our assertion that much of the panic was technical in nature. The positive momentum factor which had taken the brunt of the selling pressure regained its footing. This just means that all the puking from the quantitative funds, panicking hedge funds, and retail stop losses (after being too early to buy the dip) was exhausted at the exact same time. Adding to the chaos, the rate of change of gamma in the options market had increased sharply. This dynamic, known as “speed” in the options world and “jerk” in the physics world (the rate of change of acceleration), results in dealers chasing their tails more than just the usual gammas squeeze (forced to buy high and sell low). But unless something breaks structurally (usually resulting in funding stress), this type of acute pain is usually short-lived. And then when Volatility cools, the dynamic often reverses (sellers buy back in!).